Maine iGaming Bill Clears Legislature, Governor’s Veto Lurks

- 17 Jun 2025

- Gambling News

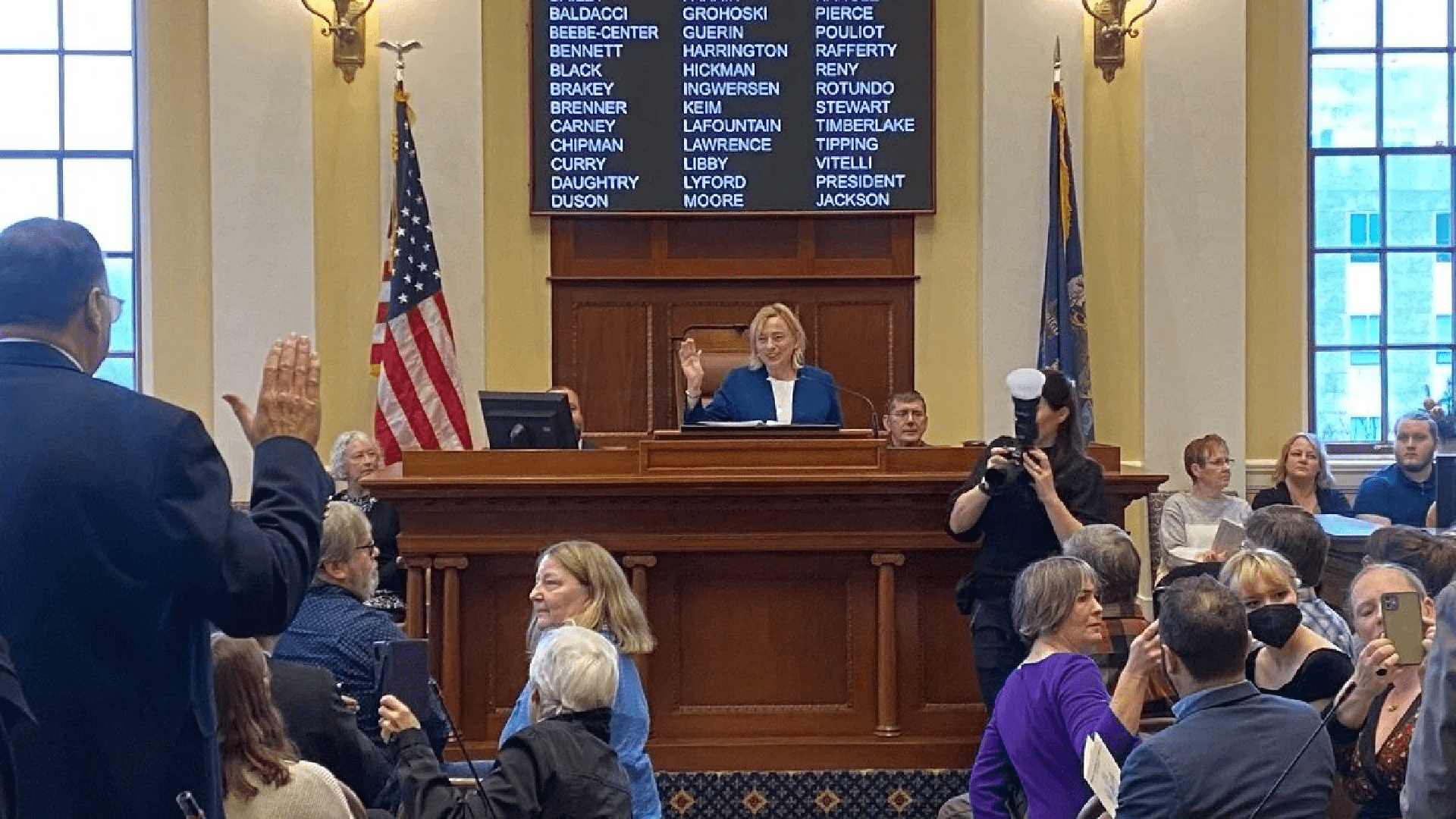

The Maine State Legislature has passed a law to permit online casino gambling.

After a deadlock in the Senate Monday evening over the tax rate for iGaming revenue being set at either 16% or 18%, leaders in the upper chamber requested the Legislature to conduct a roll call on the Veterans and Legal Affairs Committee's recommendations concerning Legislative Document 1164/House Paper 769.

The chambers approved the committee's support for the bill spearheaded by Rep. Ambureen Rana (D-Bangor).

Earlier this month, the Veterans and Legal Affairs Committee revived the iGaming bill that it had put on hold prior to the Legislature’s March 20 recess. Following Gov. Janet Mills (D) summoning lawmakers back to the State House in Augusta for a special session to seek greater consensus on the state's two-year budget, the committee reevaluated the iGaming statute, as it has the potential to produce new tax revenue.

iGaming Legislation Information

The Legislature consented to grant the four Wabanaki Nations tribes — the Maliseet, Micmac, Passamaquoddy, and Penobscot — the sole rights to conduct online casino games via third-party partners. The tribes are prohibited from operating land-based slot machines and table games; however, they secured exclusive rights to online sports betting in 2022 via state legislation.

Maine's 1980 Indian Claims Settlement Act regards the Wabanaki Nations as more similar to municipalities rather than as sovereign nations. The tribes have continuously attempted to negotiate Class III gaming compacts with the state to enable them to establish land-based casinos, but have been unsuccessful. The tribes, nonetheless, run bingo halls.

Legislative Document 1164/House Paper 769 would permit each of the four tribes to choose one iGaming partner to operate iGaming for them. The government would collect 16% of the gross gaming revenue from every operation. The tribes and their chosen partners, such as FanDuel and DraftKings, would establish revenue-sharing agreements based on their own conditions.

Tribal advocates argue that iGaming could establish a basis for independence while enhancing their online sports wagering activities. Fiscal projections indicate that the state might generate approximately $3.6 million each year from iGaming at a 16% tax rate. This indicates that the tribes and their iGaming associates might retain about $18.9 million annually from online casino games.

Resistance Ahead

The two commercial casino operators in the state, Penn Entertainment and Churchill Downs, which manage Hollywood Casino Bangor and Oxford Casino Hotel respectively, are against permitting the tribes to engage in internet gambling. The two terrestrial casinos provide over 3,200 jobs and produced $61 million in state gaming taxes in the previous year.

The casinos will certainly urge Mills to reject the tribal iGaming bill. The governor has previously voiced her opposition to the expansion of gaming, while the state’s Department of Health and Human Services is against the online gambling initiative since it encourages more gambling.

Mills’ press secretary refused to provide an official statement from the governor regarding the statute approved by the Legislature, stating simply that the governor is “monitoring the bill.”